Our Method

~

Our Method ~

So, how do we help our ventures?

We prioritize 2 things, growth of ventures, and proliferation of environmental technology. Unlike other venture capital outlets, we don't seek solely monetary gain and don’t evaluate businesses for “exit opportunities”. Instead we stand by our ventures and hope to see growth. We handpick our investors and organize investments so that investors succeed when our ventures succeed.

A bit more about our investment style..

SEEDS has created a signature 2-step investment, using fixed-income and equity principles. We believe this can stand to benefit both the venture and investor parties.

We first collect information from our venture. We take into account several factors, including technology, patents, market. size, traction, the venture team and financial information. Investment goals are decided, and we analyze plans on how investment capital will be used for growth. Using our experience with DCF valuation models, we estimate the valuation of ventures. Using all of this, we prepare venture summaries.

Funding:

Of course, the investment starts with the initial capital to the venture. While this step may seem simple, we carefully analyze both parties. We look for ventures producing disruptive technology with significant environmental benefit, with high potential and plans for growth. Similarly, we look for investors who seek to use their capital to benefit the environment around them and demonstrate commitment to our cause.

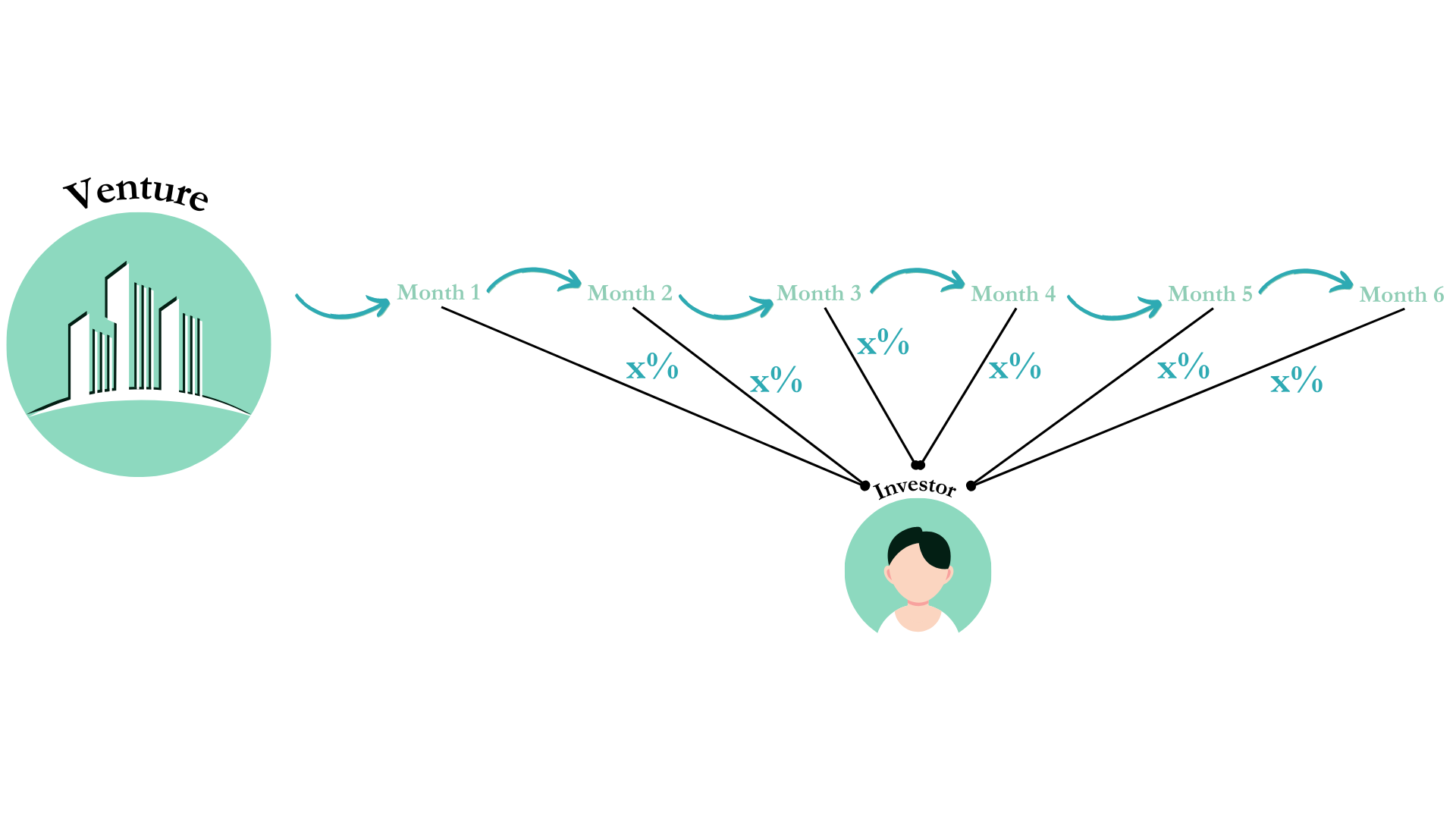

Over the coming months we look forward to seeing our ventures prosper. We hope to see growth in cashflows. The venture begins the first step the investment return over the following months. A previously agreed-on percent of the revenue is granted to the investors until a maturity period. In this way, the investor succeeds from the success and growth in revenue of the venture. At the same time, a majority of the cashflow is kept by the venture, which allows it to be used to further pursue growth.

Stage 1:

Finally, the investment reaches maturity. At this point, the majority of the return is made. A previously agreed on portion of the initial capital is returned. This way, the venture is given significant time to grow and build cashflows to support returning the investment. Additionally, this second stage of investment offers the investor a guarantee of safety, making this investment relationship desirable for both the venture and investor